Products > Housing Tax Credits

The federal Low-Income Housing Tax Credit (LIHTC) program, created in 1986 and made permanent in 1993, is the most successful program in history for financing the creation and preservation of affordable rental housing. With over 31 years of tax credit financing experience and with a strong and geographically diverse portfolio of properties, MHIC is a market leader and the syndicator of choice among sponsors and developers in Massachusetts and across New England.

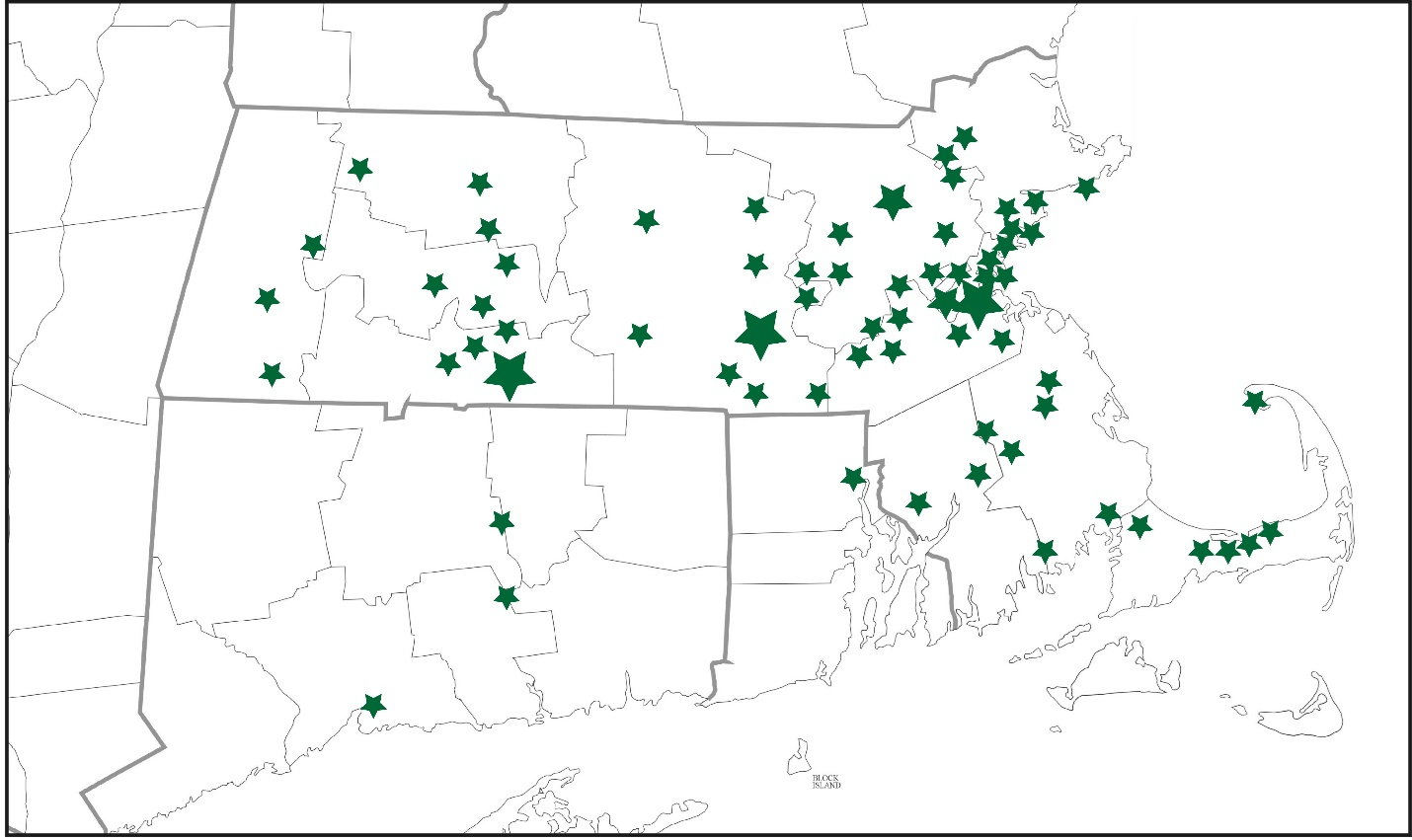

Since 1990, MHIC's Housing Tax Credit program has provided over $1.3 billion in financing, creating, or preserving over 15,000 homes in nearly 100 Massachusetts, Rhode Island, and Connecticut communities.

Our Housing Tax Credit program provides equity financing for affordable housing and community development projects that use federal low-income housing tax credits or federal historic tax credits, or a combination of both. We finance new construction, rehabilitation of existing housing, and historic rehabilitation of existing housing.

Carter School Apartments in Leominster transformed from an outdated school to offer 39 family rental apartments with $9.2 million in housing and historic tax credits from MHIC.

MHIC provided $9.7 million in housing tax credits for new construction of Finch Cambridge, the largest affordable housing development in Cambridge in 40 years.

For examples of developments financed with Housing Tax Credits, click here.

Housing Tax Credits

The federal Low-Income Housing Tax Credit (LIHTC) program, created in 1986 and made permanent in 1993, is the most successful program in history for financing the creation and preservation of affordable rental housing. With over 31 years of tax credit financing experience and with a strong and geographically diverse portfolio of properties, MHIC is a market leader and the syndicator of choice among sponsors and developers in Massachusetts and across New England.

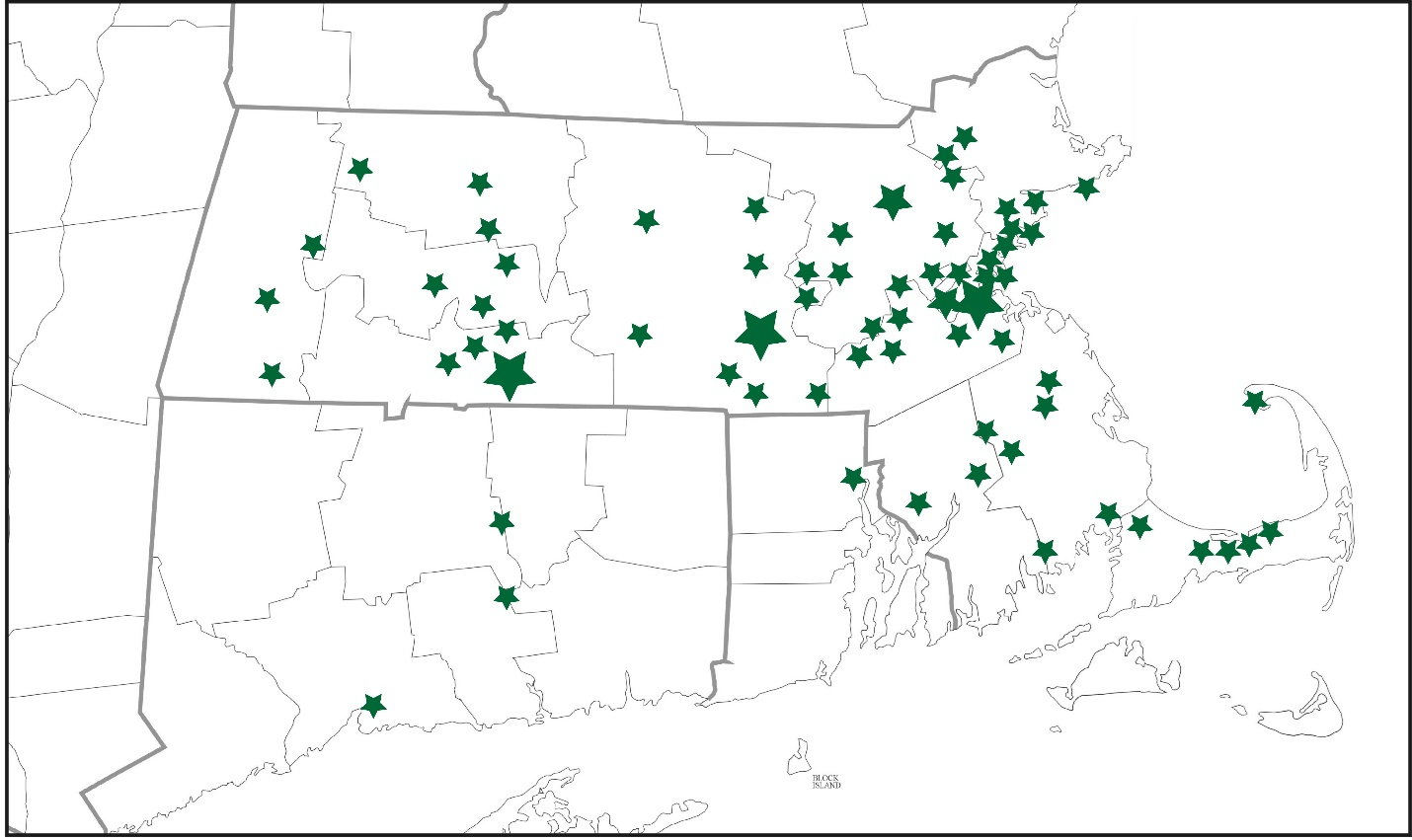

Since 1990, MHIC's Housing Tax Credit program has provided over $1.3 billion in financing, creating, or preserving over 15,000 homes in nearly 100 Massachusetts, Rhode Island, and Connecticut communities.

Our Housing Tax Credit program provides equity financing for affordable housing and community development projects that use federal low-income housing tax credits or federal historic tax credits, or a combination of both. We finance new construction, rehabilitation of existing housing, and historic rehabilitation of existing housing.

Carter School Apts.

Finch Cambridge Properties

Carter School Apartments in Leominster transformed from an outdated school to offer 39 family rental apartments with $9.2 million in housing and historic tax credits from MHIC.

MHIC provided $9.7 million in housing tax credits for new construction of Finch Cambridge, the largest affordable housing development in Cambridge in 40 years.

For examples of developments financed with Housing Tax Credits, click here.